unemployment tax credit refund date

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The IRS has sent 87 million unemployment compensation refunds so far.

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

If you see a code 290 with 000.

. Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Education Tax Credit Form and. If you apply for a tax refund loan prior to filing your taxes we highly recommend you file your taxes quickly to avoid the need to file for a loan extension. Dont sweat it it doesnt mean youre not getting a refund.

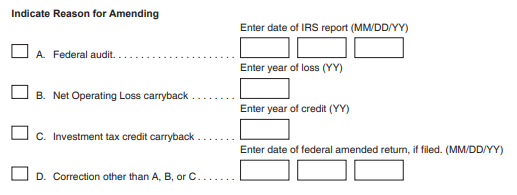

Just got off the phone with IRS 45min wait. Taxpayers should file an amended return if they. Then you can look at all your tax info.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The IRS will start. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. A quick update on irs unemployment tax refunds today. Of Time To File US.

Tax refunds on unemployment benefits to start in May. Fast Tax Refund Loan In a matter of. Individual Income Tax Return and pay what you.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Did not submit a Schedule 8812 with the original return to claim the Additional Child Tax Credit and are now eligible for the. The American Rescue Plan which President Joe Biden signed in mid-March waived federal tax on up to 10200 of unemployment benefits per person.

Refund of State Unemployment Tax In response to the COVID-19 pandemic my state has issued a refund of first quarter 2020 state unemployment taxes. Provide each shareholder with a copy of Schedule K-1 Form 1120S Shareholders Share of Income Credits. Welfare to Work Credits offer businesses a credit of up to 3500 in the first year of employment and 5000 in the second year for each newly hired long-term welfare recipient.

1099 G Unemployment Compensation 1099g

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Some May Receive Extra Irs Tax Refund For Unemployment

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

When Will Unemployment Tax Refunds Be Issued King5 Com

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

1040 2021 Internal Revenue Service

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Report Unemployment Benefits Or Income On Your Tax Return

When Will Irs Send Unemployment Tax Refunds In June How Many People Are Receiving Them As Usa

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Unemployment Benefits In Ohio How To Get The Tax Break

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Here S What You Need To Know